About our company

Our database of respondents is the largest available online panel in the Baltic states (with 68K active respondents in Baltics). Panel of respondents is most important part of research project as it is a source of high quality and reliable data. To ensure that the panel is responsive, representative and reliable is at the heart of our company.

Our research services has been already used by approximately 100 brands in the Baltic countries. Taking into account the large amount of projects, we have created reliable KPIs for brand and advertising research.

SolidData client list includes media/marketing companies; brands from various industries (FMCG, DYI, etc.) as well as international research agencies that don’t have their own panels in Baltic States. Clients from various fields appreciate our flexibility to meet the research needs at competitive prices.

Brand, post-campaign analysis. Consumer habits, social studies

Most frequent research topics with us:

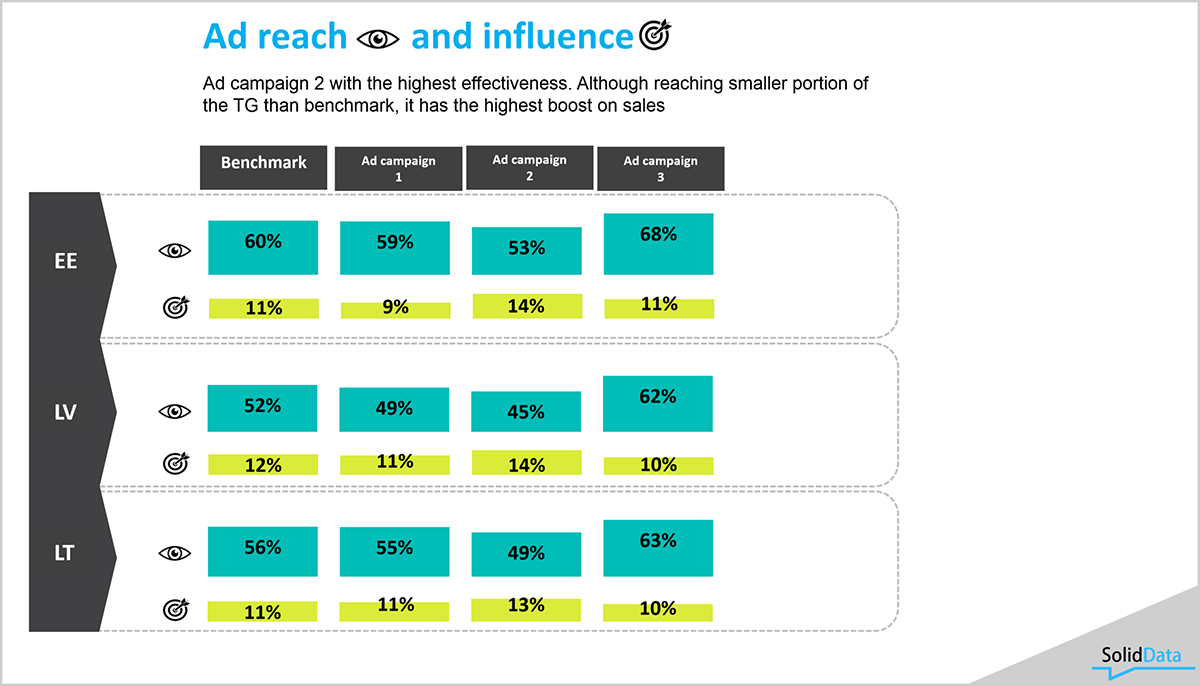

- Advertisement research. Post-ad analysis, influence in the target group

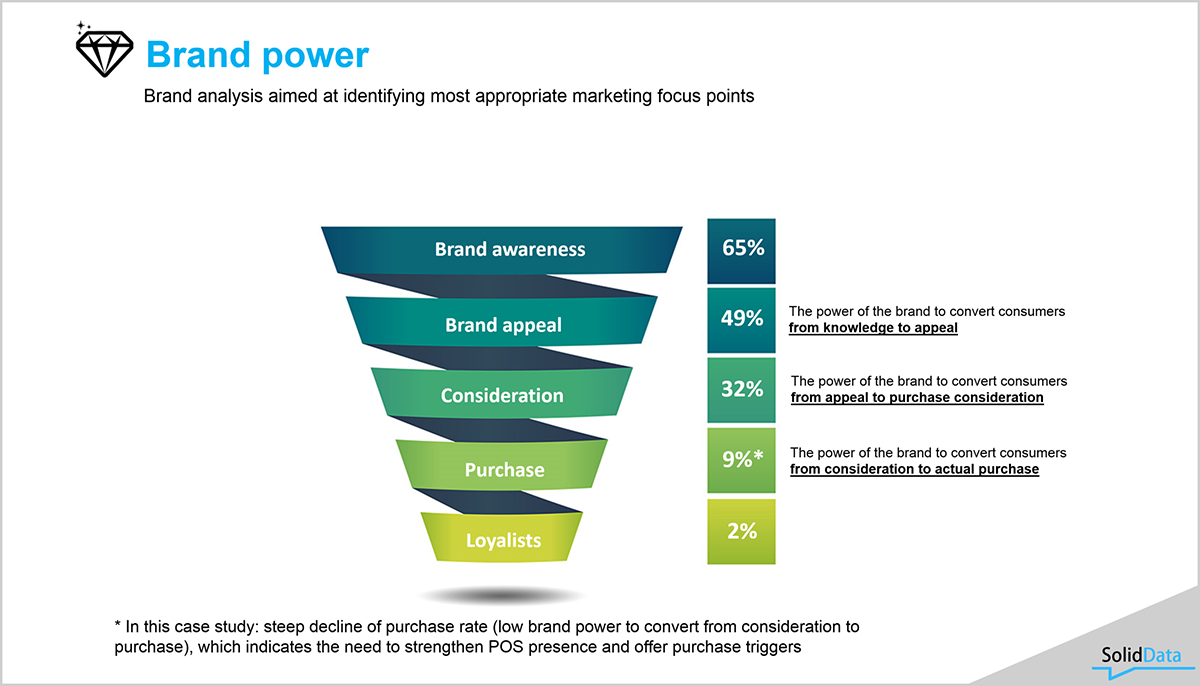

- Brand evaluation (KPIs) compared to the closest competitors

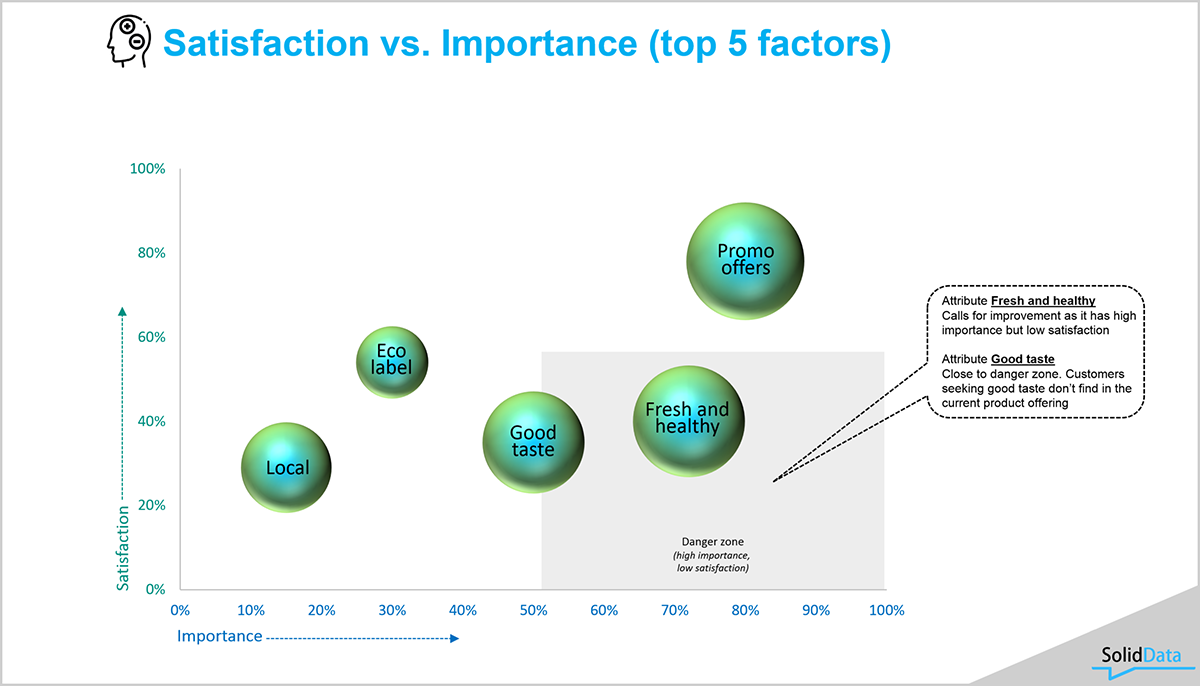

- Purchase triggers; USP and differentiation analysis.

- User profiling and segmentation

- Packaging tests and product development. Likeability and influence on sales boost

- Purchase behaviour, attitudes and lifestyle

- Social studies

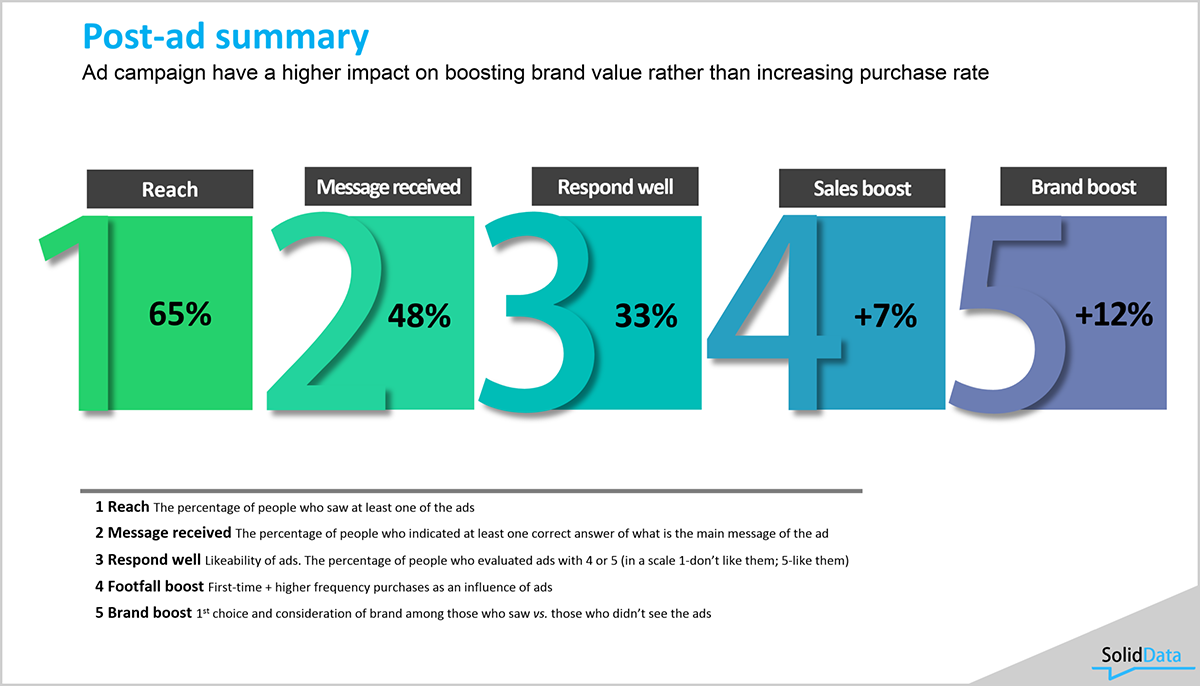

Examples of post-campaign analysis:

Examples of brand analysis:

Survey technical solutions

We provide online survey technical solutions for you own research studies - client or employee surveys. Our online survey tool and in-house programmers will ensure smooth running of the technical side of your research project. You will get survey data summarized in charts or raw Excel data.

- Online survey tool where you can create the survey yourself. For more advanced solutions we provide programming services

- Possibility to upload your company's logo and customize visual template of the survey

- Our research professional can help with creating your survey questions

- Each respondent has a unique survey link, which provides an opportunity to monitor respondents that have completed the survey or re-send a reminder

- Solutions for organizing prize draws to motivate customers to participate in your survey. Fortune wheel at the end of the completed survey

Atbildot uz klientu specifiskām prasībām aptauju tehniskajā nodrošināšanā, esam izveidojuši aptauju rīku, kur īsā laikā var izveidot dažāda apjoma online aptaujas. Sarežģītāku risinājumu nodrošināšanai piedāvājam programmēšanas pakalpojumus.

Online panel. Recruitment of respondents

Our database of respondents is the largest available online panel in the Baltic states (with 68K active respondents in Baltics). Panel of respondents is most important part of research project as it is a source of high quality and reliable data.

Our quality procedures ensure that the panel is responsive, representative and reliable.

- During the recruitment process new panellists are informed and they agree to participate in market research surveys. Voluntary basis come and go.

- Regular panel screening to remove unresponsive and low-quality panellists (straight-lining, trick questions, etc.)

- Panel management is compliant with all relevant market research industry standards, data protection and privacy laws

Samples are drawn from the panel according to client’s specification (either nationally representative, or targeted) and randomly selected within the database

Omnibus surveys

Quick and affordable way to get answers on your questions within your target group.

- Omnibus surveys are organized on a regular basis and deliver a representative, statistically reliable sample (in the age 18-74). A total of 1000 respondents are delivered, in quotas by gender, age, region and other demo criteria. If required, we can arrange a smaller sample of respondents, reducing your costs accordingly.

- Timings: data delivery within 3-6 business days

- Data delivery: Summary of answers in a total sample and data cuts by demo groups.

Feel free to contact us! We will provide you with prompt answers about prices, deadlines and other questions.